- What Is Vehicle Depreciation and Why It Matters for Car Value

- Average Car Depreciation Rate on Dubai’s Used Car Market

- Key Factors Affecting Car Resale Value in Dubai

- Financial Impact of Depreciation on Car Owners

- How to Reduce Car Depreciation in Dubai

- Renting a Car as an Alternative to Ownership

- Ownership vs Flexible Car Use in Dubai

- FAQ

Depreciation strikes fast in Dubai, as here cars depreciate at a higher depreciation rate than global norms due to the UAE’s rapid vehicle turnover. High demand for fresh models means drivers often resell after 1-2 years, flooding the resale market and causing vehicles to lose value quickly from the purchase price.

In this environment, depreciation in the UAE (especially Dubai) demands attention, as it overshadows fuel or insurance in true ownership costs. We will discuss the annual depreciation trends and help you predict how your car will lose value over time and make savvy decisions.

What Is Vehicle Depreciation and Why It Matters for Car Value

Vehicle depreciation is the steady drop in a car’s worth as it ages, driven by wear and tear, mileage, and shifting market tastes. It turns your purchase price into resale scraps. It starts from the dealership exit: expect 20-30% gone in year one, with value over time eroding further through annual depreciation.

Why care? In the UAE, depreciation often becomes the biggest hidden cost, making maintenance senseless. Cars depreciate quickest here, in Dubai, due to resale frenzy. However, grasping depreciation rates lets you make the purchase, like the Toyota Land Cruiser, for example, and minimize losses on trade-ins.

Average Car Depreciation Rate on Dubai’s Used Car Market

There are several key factors that drive car depreciation, making it essential for buyers to focus on practical aspects like the following:

- Age and mileage: Cars over 3 years or 50,000 km lose 40-50% value fast, as Dubai buyers favor low-mileage imports from gray markets.

- Service history: Clean records from UAE-authorized centers like Al-Futtaim boost resale by 10-15%, proving reliability in desert heat.

- Brand and demand: Toyota or Nissan hold value due to high UAE off-road demand; luxury niches like Audi plummet without broad appeal.

- Engine type and efficiency: Hybrids/efficient petrol models depreciate slower amid oil price swings and Dubai’s green push.

- Overall vehicle condition: Sand-damaged paint or worn interiors slash prices on DubiCars, where pristine cars sell quickest.

These Dubai-specific drivers emphasize buying low-usage, serviced models for better resale in the UAE’s turnover-heavy market.

Key Factors Affecting Car Resale Value in Dubai

Dubai’s used car market has specific local pressures like heat and high turnover, where understanding depreciation key factors is crucial:

- Age and mileage: Over 3 years or 50,000 km slashes vehicle value by 40-50% via accumulated depreciation, as buyers hunt low-km imports.

- Service history: UAE-authorized logs create a well-maintained car, adding 10-15% to resale value in the UAE and proving sand-proof reliability.

- Brand and demand: Toyota holds firm on off-road hype. Rare luxuries lose value faster without mass appeal in regions like the UAE.

- Engine type and efficiency: Hybrids slow depreciation calculations amid oil swings and green shifts.

- Overall vehicle condition: Sand-scratched paint drops prices fast due to wear and tear.

Financial Impact of Depreciation on Car Owners

Depreciation expense crushes budgets via resale hits and creeping costs in Dubai, where annual depreciation expense outpaces car insurance.

- Resale value decline: Fresh buys shed 25% instantly from import waves, eroding resale value in the UAE.

- Resale losses: When Dubai car owners try to sell (or “flip”) their vehicle quickly (say, after 1-2 years), they often get back only about 50% of what they originally paid, because the car’s value drops sharply and rapidly due to heavy depreciation in the local market.

- Long-term ownership costs: Over several years of owning a car in the UAE, the ongoing loss in the car’s value (depreciation) adds up to more money lost than what you spend on fuel, steadily increasing your total expenses each year, treating the car like a “fixed asset” that just keeps draining your finances rather than holding worth.

How to Reduce Car Depreciation in Dubai

Smart choices help vehicle owners minimize car depreciation in Dubai’s tough market.

- Regular servicing: Builds buyer-trusted records at certified shops for a well-maintained car.

- Careful operation: Limits mileage and avoids road/climate damage to extend useful life.

- High-demand models: SUVs keep higher resale values than other cars. Use a car depreciation calculator to pick winners.

- Preserve documentation: Receipts prove pristine history with accurate depreciation tracking.

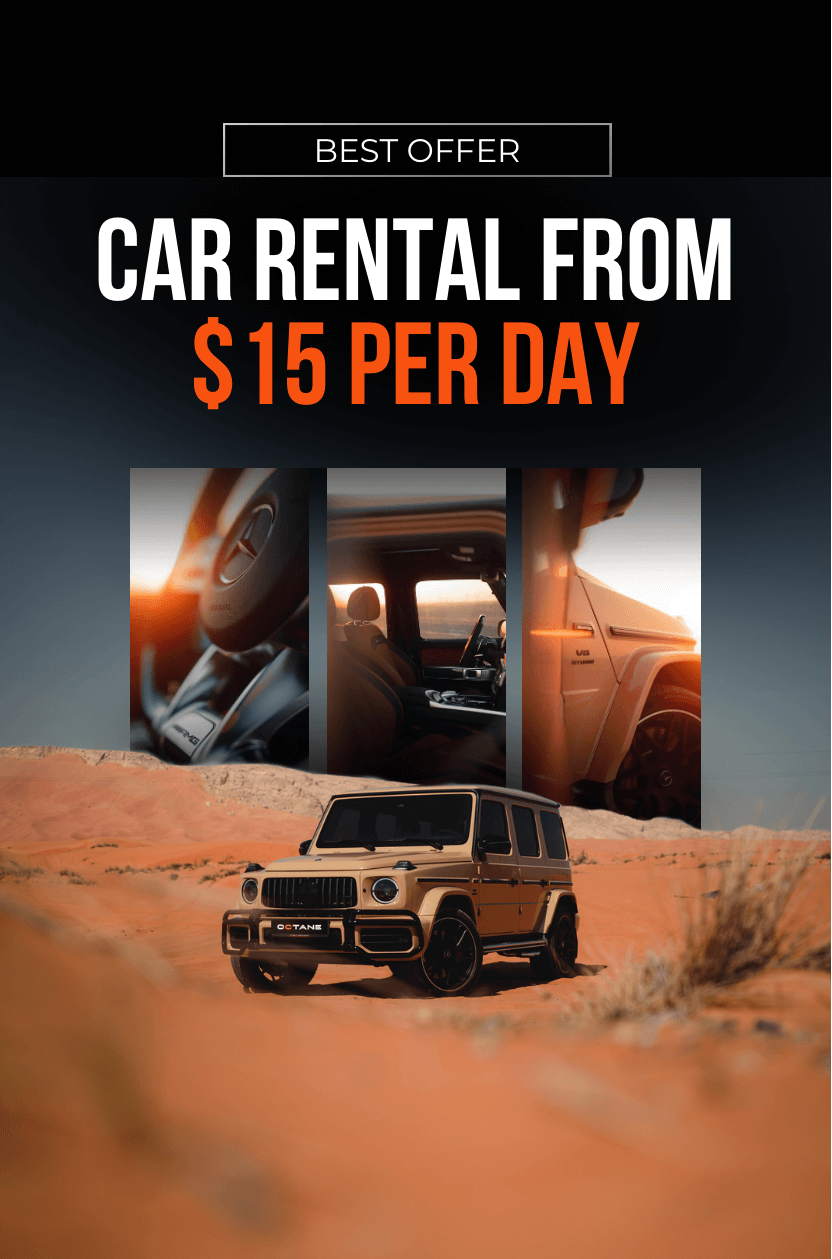

Renting a Car as an Alternative to Ownership

Renting a car in Dubai offers a smart way to completely sidestep car depreciation, as you never take on vehicle ownership and escape depreciation. Instead of watching your asset lose worth from mileage, market trends, or wear, you return the car, leaving losses to the provider. This is quite appealing in the high-turnover UAE market, as it lets renters drive fresh vehicles without depreciation expense.

Octane.Rent provides premium access free from resale pressures, car value declines, or extended commitments.

Ownership vs Flexible Car Use in Dubai

Car ownership means taking on the full weight of depreciation, including upfront purchase costs, vehicle insurance, maintenance, and resale hassles in Dubai’s competitive market. Renting and flexible use give on-demand access to different models with easy switches, skipping any personal depreciation expense or long-term commitments.

For many drivers in Dubai, like expats or frequent upgraders, flexibility matters more than owning a car outright. In short, depreciation is an unavoidable part of car ownership in Dubai, but smart habits or renting can control or avoid it completely.